! pip install numpy-financial^Cnumpy-financial and monte-carlo simulation to evaluate investments.

Peter Amerkhanian

August 6, 2022

This post goes through the following exercises:

numpy-financial to build a loan amortization calculator for a home mortgagenumpy-financialAt one point in time, numpy, the popular Python numerical analysis library, included 10 specialized functions for financial analysis. Given their specific nature, they were eventually removed from numpy, I think in 2019 (learn about why that is here) and are now available in the separate library, numpy-financial. The library still seems focused on the same 10 core functions, which handle tasks like calculating loan payment amounts given some inputs, and applied financial economics tasks like calculating time value of money. Cool… Anyways, I’ll use it to create an amortization schedule for a mortgage.

I built this notebook in a Google Colab instance, which seems to include most major Python libraries (more info).

You’ll probably have to download numpy-financial (it’s not included in Anaconda as far as I know), which you can accomplish within any notebook-like environment using the following command:

You’ll want to load the usual suspects - pandas, numpy, seaborn, matplotlib. I also run from datetime import datetime since we will be working with ranges of dates, and I run sns.set_style() to get my seaborn plots looking a bit more aesthetically pleasing - read more on themes here.

I’ll run this as a comparison between buying an apartment that costs $700,000 with a 20% downpayment, versus renting a home for $2,600 a month. This is meant to approximate buying versus renting a two-bed one-bath apartment.

Buying fees are defined at 4%, the homeowners association fees are defined as $700 monthly.

npf.pmt() can be used to generate a monthly mortgage payment given those buying constants:

alternatively, we can use npf.ppt() to see how much of the payment goes towards the principal, and use npf.ipmt() to see how much goes towards interest (see below for applications of those functions).

I’ll make the simplifying assumption that both “annual home appreciation” and “annual stock appreciation” are generated from normal distributions. This is a kind of strong assumption, but one that seems to be routinely made at least with regards to stock market returns, even if there might be better distribution choices out there (more here).

Here’s a look at how we’ll draw from a normal distribution. Given an average annual return, \(\mu = 0.0572\) (\(\mu\), or, mu, is a common variable name for average) and a standard deviation \(\sigma = 0.1042\) (\(\sigma\), or, sigma, is the common variable name for standard deviation), we can draw one sample from a normal distribution as follows:

# Download S&P 500 data

sp500 = yf.download("AAPL", start="1950-01-01")["Adj Close"].dropna()

sp500 = sp500.dropna()[*********************100%***********************] 1 of 1 completedERROR

1 Failed download:

ERROR ['AAPL']: Exception('AAPL: No price data found, symbol may be delisted (1d 1950-01-01 -> 2025-05-31)')from statsmodels.tsa.seasonal import STL

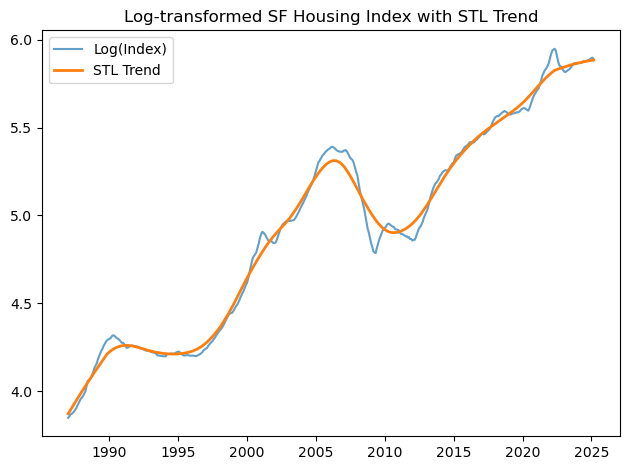

# -- STL DECOMPOSITION --

stl = STL(log_prices, period=36)

res = stl.fit()

trend = res.trend

resid = res.resid

# === 1. Plot log prices with trend ===

plt.figure()

plt.plot(log_prices, label='Log(Index)', alpha=0.7)

plt.plot(trend, label='STL Trend', linewidth=2)

plt.title('Log-transformed SF Housing Index with STL Trend')

plt.legend()

plt.tight_layout()

plt.show()

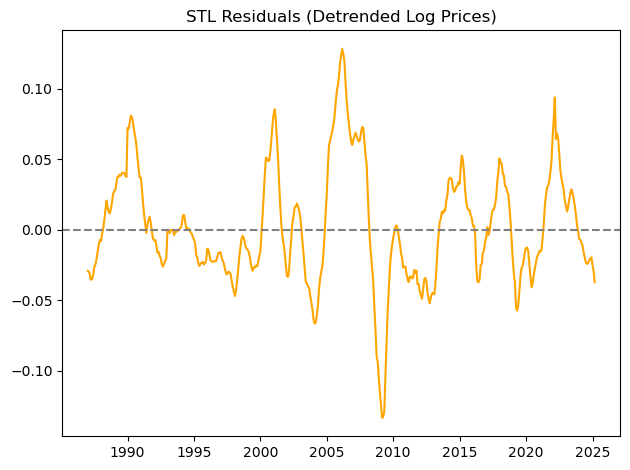

# === 2. Residual diagnostics ===

plt.figure()

plt.plot(resid, label='STL Residuals', color='orange')

plt.axhline(0, linestyle='--', color='gray')

plt.title('STL Residuals (Detrended Log Prices)')

plt.tight_layout()

plt.show()

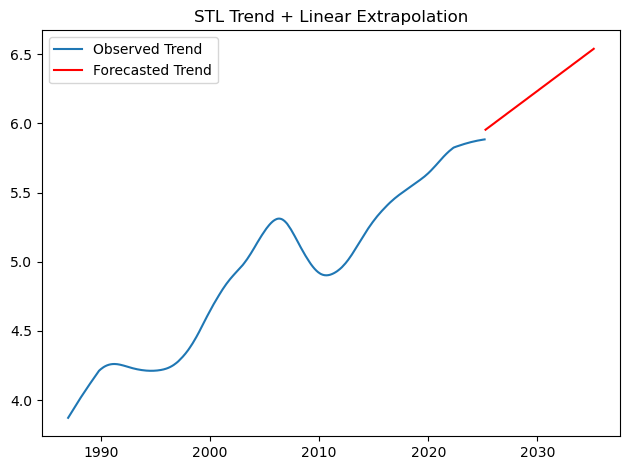

# === 3. Fit linear model to trend (last N years) ===

trend_recent = trend.last(f'{N_years}Y')

X = np.arange(len(trend_recent)).reshape(-1, 1)

y = trend_recent.values

model = LinearRegression().fit(X, y)

X_future = np.arange(len(X), len(X) + future_months).reshape(-1, 1)

trend_forecast = model.predict(X_future)C:\Users\peteramerkhanian\AppData\Local\Temp\ipykernel_66512\1996583068.py:2: FutureWarning: last is deprecated and will be removed in a future version. Please create a mask and filter using `.loc` instead

trend_recent = trend.last(f'{N_years}Y')

C:\Users\peteramerkhanian\AppData\Local\Temp\ipykernel_66512\1996583068.py:2: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

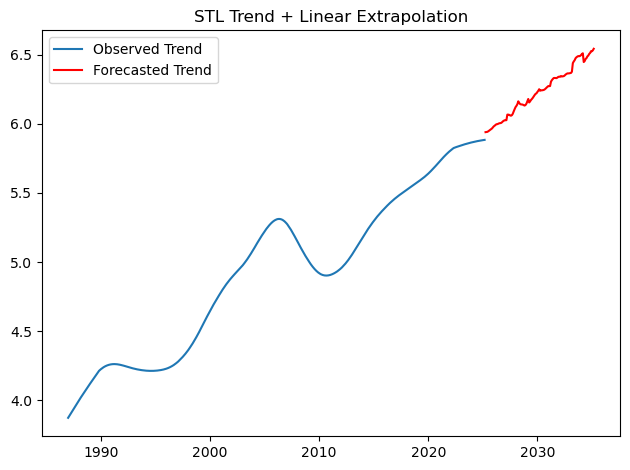

trend_recent = trend.last(f'{N_years}Y')# Plot extrapolated trend

plt.figure()

plt.plot(trend, label='Observed Trend')

plt.plot(

pd.date_range(trend.index[-1] + timedelta(days=30), periods=future_months, freq='MS'),

trend_forecast,

color='red', label='Forecasted Trend'

)

plt.title('STL Trend + Linear Extrapolation')

plt.legend()

plt.tight_layout()

plt.show()

# === 4. Show example of block bootstrapped residuals ===

def block_bootstrap(residuals, n_periods, block_size=4):

blocks = []

n_blocks = int(np.ceil(n_periods / block_size))

for _ in range(n_blocks):

start = np.random.randint(0, len(residuals) - block_size)

blocks.extend(residuals[start:start + block_size])

return np.array(blocks[:n_periods])

sample_boot = block_bootstrap(resid.dropna(), future_months, block_size)plt.figure()

plt.plot(sample_boot, color='purple')

plt.axhline(0, linestyle='--', color='gray')

plt.title('Example: Block Bootstrapped Residuals (Simulated Noise)')

plt.tight_layout()

plt.show()

# Plot extrapolated trend

plt.figure()

plt.plot(trend, label='Observed Trend')

plt.plot(

pd.date_range(trend.index[-1] + timedelta(days=30), periods=future_months, freq='MS'),

(trend_forecast + sample_boot),

color='red', label='Forecasted Trend'

)

plt.title('STL Trend + Linear Extrapolation')

plt.legend()

plt.tight_layout()

plt.show()

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

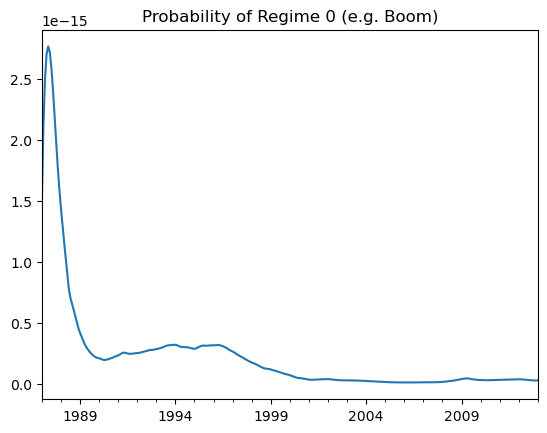

from statsmodels.tsa.regime_switching.markov_regression import MarkovRegression

# Step 1: Convert log prices to returns

# insert your data here

returns = np.diff(log_prices) # log returns

# Step 2: Fit Markov Switching model (e.g., 2 regimes, AR(1) in each)

model = MarkovRegression(returns, k_regimes=2, trend='c', switching_variance=True)

result = model.fit()

# Step 3: Summary and regime probabilities

print(result.summary())

# Smoothed regime probabilities

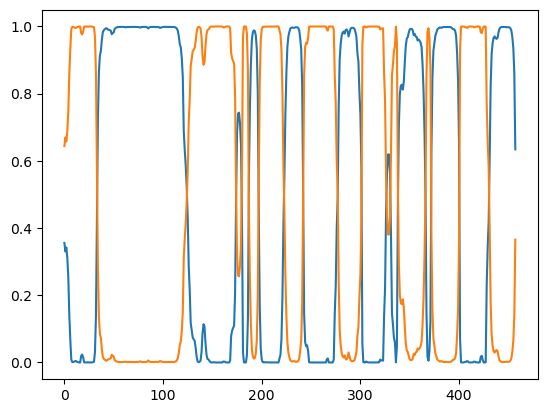

smoothed_probs = result.smoothed_marginal_probabilities

plt.plot(smoothed_probs)

plt.show() Markov Switching Model Results

==============================================================================

Dep. Variable: y No. Observations: 458

Model: MarkovRegression Log Likelihood 1485.238

Date: Sat, 31 May 2025 AIC -2958.477

Time: 12:27:11 BIC -2933.715

Sample: 0 HQIC -2948.724

- 458

Covariance Type: approx

Regime 0 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0009 0.001 1.472 0.141 -0.000 0.002

sigma2 2.722e-05 3.31e-06 8.213 0.000 2.07e-05 3.37e-05

Regime 1 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0082 0.001 7.744 0.000 0.006 0.010

sigma2 0.0002 2.52e-05 8.680 0.000 0.000 0.000

Regime transition parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

p[0->0] 0.9607 0.014 68.720 0.000 0.933 0.988

p[1->0] 0.0410 0.016 2.640 0.008 0.011 0.071

==============================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

from sklearn.metrics import r2_score, mean_squared_error, mean_absolute_error

# 1. Define split point

split_date = '2013-01-01'

log_prices_train = log_prices[:split_date]

log_prices_test = log_prices[split_date:]

n_test = len(log_prices_test)

# 2. STL on training data

stl_train = STL(log_prices_train, period=12).fit()

trend_train = stl_train.trend

resid_train = stl_train.resid.dropna()

# Extrapolate trend linearly from last N years of training trend

trend_recent = trend_train.last('10Y')

X = np.arange(len(trend_recent)).reshape(-1, 1)

y = trend_recent.values

model = LinearRegression().fit(X, y)

X_future = np.arange(len(X), len(X) + n_test).reshape(-1, 1)

trend_forecast = model.predict(X_future)

# Bootstrap residuals and add to trend forecast

sim_resid_stl = block_bootstrap(resid_train, n_test, block_size)

sim_log_stl = trend_forecast + sim_resid_stl

sim_prices_stl = np.exp(sim_log_stl)

# 3. Fit normal distribution to training log returns

log_returns_train = log_prices_train.diff().dropna()

mu, sigma = log_returns_train.mean(), log_returns_train.std()

# Simulate log returns and add to final value of training log prices

sim_log_returns_normal = np.random.normal(mu, sigma, size=n_test)

sim_log_normal = [log_prices_train.iloc[-1]]

for r in sim_log_returns_normal:

sim_log_normal.append(sim_log_normal[-1] + r)

sim_log_normal = sim_log_normal[1:]

sim_prices_normal = np.exp(sim_log_normal)

# 4. True test log prices

true_log_prices = log_prices_test[:n_test]

# 5. Evaluation metrics

def evaluate(pred, truth, label):

r2 = r2_score(truth, pred)

rmse = mean_squared_error(truth, pred, squared=False)

mae = mean_absolute_error(truth, pred)

print(f"📊 {label} Forecast Performance")

print(f"R²: {r2:.4f}")

print(f"RMSE: {rmse:.4f}")

print(f"MAE: {mae:.4f}\n")

evaluate(sim_log_stl, true_log_prices, "STL + Bootstrap")

evaluate(sim_log_normal, true_log_prices, "Normal Sim")

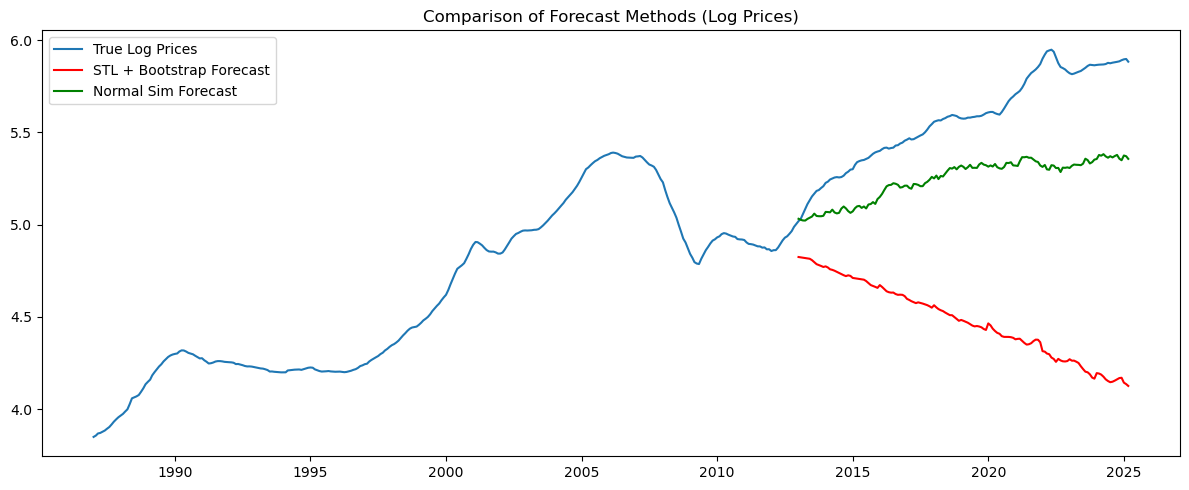

# 6. Plot for visual comparison

plt.figure(figsize=(12, 5))

plt.plot(log_prices, label='True Log Prices')

plt.plot(log_prices_test.index, sim_log_stl, label='STL + Bootstrap Forecast', color='red')

plt.plot(log_prices_test.index, sim_log_normal, label='Normal Sim Forecast', color='green')

plt.title('Comparison of Forecast Methods (Log Prices)')

plt.legend()

plt.tight_layout()

plt.show()C:\Users\peteramerkhanian\AppData\Local\Temp\ipykernel_66512\2205870326.py:15: FutureWarning: last is deprecated and will be removed in a future version. Please create a mask and filter using `.loc` instead

trend_recent = trend_train.last('10Y')

C:\Users\peteramerkhanian\AppData\Local\Temp\ipykernel_66512\2205870326.py:15: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

trend_recent = trend_train.last('10Y')📊 STL + Bootstrap Forecast Performance

R²: -22.5005

RMSE: 1.1821

MAE: 1.0954

📊 Normal Sim Forecast Performance

R²: -1.2241

RMSE: 0.3636

MAE: 0.3324

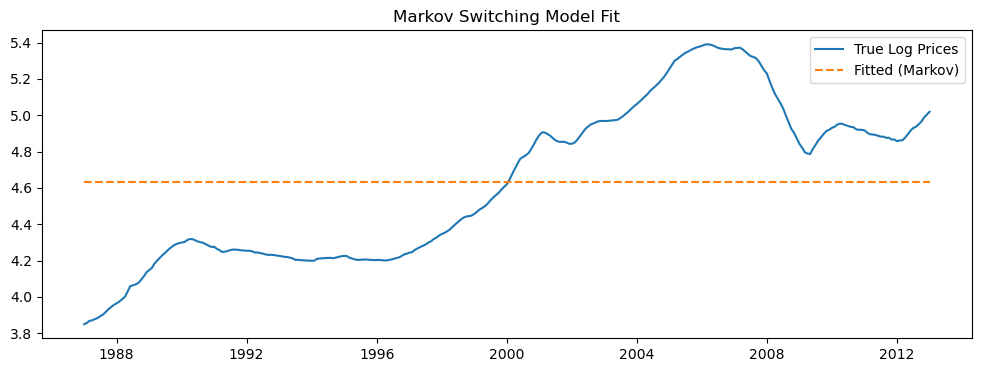

from statsmodels.tsa.regime_switching.markov_regression import MarkovRegression

# Markov switching model with 2 regimes: mean & variance change

model = MarkovRegression(log_prices_train, k_regimes=2, trend='c', switching_variance=False)

res = model.fit()

# Forecast future values (in-sample first)

fitted = res.fittedvalues

# Plot in-sample fit

plt.figure(figsize=(12, 4))

plt.plot(log_prices_train, label='True Log Prices')

plt.plot(fitted, label='Fitted (Markov)', linestyle='--')

plt.title("Markov Switching Model Fit")

plt.legend()

plt.show()

# Show smoothed regime probabilities

res.smoothed_marginal_probabilities[0].plot(title="Probability of Regime 0 (e.g. Boom)")c:\Users\peteramerkhanian\anaconda3\lib\site-packages\statsmodels\tsa\base\tsa_model.py:471: ValueWarning: No frequency information was provided, so inferred frequency MS will be used.

self._init_dates(dates, freq)

import pandas as pd

import numpy as np

import yfinance as yf

from fredapi import Fred

import os

# Initialize FRED API (you need to get your own API key from https://fred.stlouisfed.org/)

fred = Fred(api_key=os.environ.get('fred_api'))

# Download S&P 500 data

sp500 = yf.download('^GSPC', start='2000-01-01', interval='1mo')['Adj Close']

sp500 = sp500.dropna()

# Download San Francisco Home Price Index data

sf_home = fred.get_series('SFXRSA')

sf_home = sf_home.dropna()

# Align dates

data = pd.DataFrame({'SP500': sp500, 'SF_Home': sf_home})

data = data.dropna()

# Calculate monthly returns

returns = data.pct_change().dropna()# Set a random seed for stability of results

np.random.seed(10)

mean = .0572

standard_deviation = .1042

samples = 1

# Draw the sample

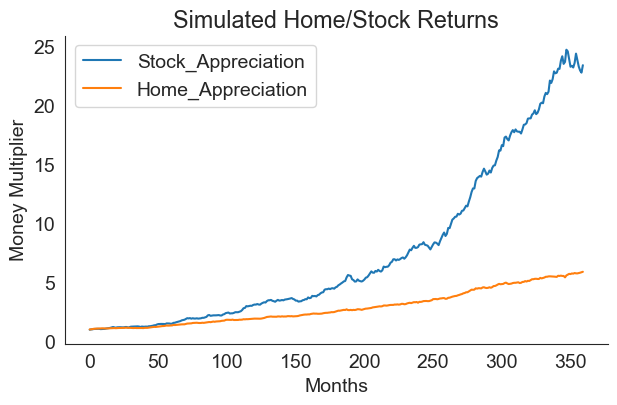

np.random.normal(mean, standard_deviation, samples)array([0.19595131])We now simulate market returns for every month by supplying mean and standard deviation values for both home and stock market appreciation and drawing 360 samples (360 months in 30 years). For simplicity, we’ll just use world-wide aggregate values from “The Rate of Return on Everything, 1870-2015”.

Given that stock and home appreciation is probably correlated, I’ll have ti sample from a bivariate normal distribution using numpy.random.Generator.multivariate_normal - documentation here, rather than the univariate distribution draw shown above. I am going to assume a correlation coefficient, \(\rho_{stock,home}\) of 0.5 - a fairly clear correlation.

In order to use that numpy function, I’ll need to translate my correlation statistic into a covariance statistic, and I’ll use the following formula (source):

\[ \begin{align*}

cov_{stock,home} &= \rho_{stock,home} \times \sigma_{stock} \sigma_{home} \\\

cov_{stock,home} &= 0.5 \times .2267 \times .1042 \end{align*}

\]

I calculate covariance and confirm that the covariance and correlations match up below:

cov = 0.5 * sigma_stock * sigma_home

print("Covariance:", cov)

print("Back to correlation:", cov / (sigma_stock * sigma_home))Covariance: 0.01181107

Back to correlation: 0.5Now that I have the covariance, I’ll be able to sample from a bivariate normal distribution of the form shown below (source).

\[

\begin{pmatrix} Stock \\\\ Home\end{pmatrix} \sim \mathcal{N} \left[ \begin{pmatrix} \mu_{s} \\\ \mu_{h}\end{pmatrix}, \begin{pmatrix} \sigma_{s}^2 & cov_{s,h} \\\ cov_{s,h} & \sigma_{h}^2\end{pmatrix} \right]

\]

Note, \(s\) is shorthand for stock and \(h\) is shorthand for home.

Now I’ll code that in Python and confirm that the means and standard deviations of our samples match what we expect:

cov_matrix = np.array([[sigma_stock**2, cov],

[cov, sigma_home**2]])

returns_df = pd.DataFrame(np.random

.default_rng(30)

.multivariate_normal([mu_stock, mu_home],

cov_matrix,

360),

columns=["Stock_Appreciation", "Home_Appreciation"])

print("Means:", returns_df.mean(axis=0).values)

print("Std. Devs:", returns_df.std(axis=0).values)

returns_df = (returns_df / 12)Means: [0.10764063 0.05970695]

Std. Devs: [0.22544095 0.10543034]Plotting the simulated values, we can see that stock market returns are typically higher than home value appreciation.

returns_df.add(1).cumprod().plot(figsize=(7,4))

plt.xlabel("Months")

plt.ylabel("Money Multiplier")

plt.title("Simulated Home/Stock Returns")

sns.despine();

Now we can define two spread-sheet-like dataframes: - one that shows a mortgage amortization schedule for if you were to buy the $600,000 home, along with the home’s appreciation over time. - one that shows a table of rent payments and the stock market growth of what would have been your down payment (you can invest the down payment since you didn’t end up purchasing a house).

# Buying Table

df_own = pd.DataFrame()

df_own["Period"] = pd.Series(range(12*30)) + 1

df_own["Date"] = pd.date_range(start=datetime.today(),

periods=12*30,

freq='MS',

name="Date")

df_own["Principal_Paid"] = npf.ppmt(interest_rate/12,

df_own["Period"],

12*30,

principal)

df_own["Interest_Paid"] = npf.ipmt(interest_rate/12,

df_own["Period"],

12*30,

principal)

df_own["HOA_Paid"] = hoa

df_own["HOA_Paid"] = df_own["HOA_Paid"].cumsum()

df_own["Balance_Remaining"] = principal + df_own["Principal_Paid"].cumsum()

df_own["Home_Value"] = round(cost * home_performance, 2)

df_own["PropTax_Paid"] = (df_own["Period"]

.apply(lambda x:

(cost * 1.02**((x-1)/12) * 0.01)

if (x-1) in list(range(0, 12*1000, 12))

else 0)

.cumsum())

df_own["Sale_Fees"] = df_own["Home_Value"] * .07

df_own["Own_Profit"] = (df_own["Home_Value"] -

df_own["HOA_Paid"] -

df_own["Balance_Remaining"] -

(buying_fees + df_own["Sale_Fees"]) -

df_own["PropTax_Paid"])

df_own = round(df_own, 2)Note this code, which is a bit of a monster:

What is happening here is a calculation of property assessed value and property tax according to California’s property assessment/tax regime (more here). We’ll look at this in two pieces, first, assessed value. In California, once you purchase a property, its assessed value is set at the purchase price, then increases annually by the lower of 2% or the rate of inflation according to the California Consumer Price Index (CCPI). You could write out an equation for this as follows:

\[ \begin{align*} AnnualFactor_y = \begin{cases} 1 + CCPI_y, & \text{if } CCPI_y < 0.02 \\\ 1.02, & \text{otherwise} \end{cases} \end{align*} \]

\(AnnualFactor\) is the amount that the assessed value of a home will appreciate (expressed as a multiplier) in a given year, \(y\). We define \(y^*\) as the year of initial purchase and \(PurchasePrice\) as the amount that the home was purchased for. Given that, \(AssessedValue\) is defined as follows:

\[ \begin{align*} AssessedValue_y = \begin{cases} PurchasePrice, & \text{if } y = y^* \\ AssessedValue_{y-1} \times AnnualFactor_y, & \text{otherwise } \end{cases} \end{align*} \]

In our code, we will simplify this calculation by excluding the CCPI and just always using 1.02 as our annual factor. Therefore, we get:

\[ AssessedValue_y = PurchasePrice \times 1.02^y \]

and once we factor in taxes (1%), we get:

\[ PropertyTax_y = 0.01(PurchasePrice \times 1.02^y) \]

and finally we look at the the cumulative total property tax you’ve paid in a given year \(y\), which is df_own["PropTax_Paid"]:

\[ \begin{equation*} PropertyTaxPaid_y = \sum_{y=1}^{30} 0.01(PurchasePrice \times 1.02^y) \end{equation*} \]

There’s some elements added to the code to work between years and months, but that equation is the gist of it.

We end up with the following table for property ownership:

| Period | Date | Principal_Paid | Interest_Paid | HOA_Paid | Balance_Remaining | Home_Value | PropTax_Paid | Sale_Fees | Own_Profit | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 2025-06-01 08:48:43.587964 | -506.25 | -3033.33 | 700 | 559493.75 | 701405.73 | 7000.000000 | 49098.40 | 62713.58 |

| 1 | 2 | 2025-07-01 08:48:43.587964 | -508.99 | -3030.59 | 1400 | 558984.76 | 707155.41 | 7000.000000 | 49500.88 | 67869.77 |

| 2 | 3 | 2025-08-01 08:48:43.587964 | -511.75 | -3027.83 | 2100 | 558473.02 | 723324.03 | 7000.000000 | 50632.68 | 82718.33 |

| 3 | 4 | 2025-09-01 08:48:43.587964 | -514.52 | -3025.06 | 2800 | 557958.50 | 737245.96 | 7000.000000 | 51607.22 | 95480.25 |

| 4 | 5 | 2025-10-01 08:48:43.587964 | -517.31 | -3022.28 | 3500 | 557441.19 | 745606.08 | 7000.000000 | 52192.43 | 103072.46 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 355 | 356 | 2055-01-01 08:48:43.587964 | -3445.26 | -94.33 | 249200 | 13968.65 | 4026844.31 | 283976.554436 | 281879.10 | 3175420.00 |

| 356 | 357 | 2055-02-01 08:48:43.587964 | -3463.92 | -75.66 | 249900 | 10504.74 | 4044808.10 | 283976.554436 | 283136.57 | 3194890.24 |

| 357 | 358 | 2055-03-01 08:48:43.587964 | -3482.68 | -56.90 | 250600 | 7022.06 | 4066823.89 | 283976.554436 | 284677.67 | 3218147.61 |

| 358 | 359 | 2055-04-01 08:48:43.587964 | -3501.54 | -38.04 | 251300 | 3520.51 | 4096809.97 | 283976.554436 | 286776.70 | 3248836.21 |

| 359 | 360 | 2055-05-01 08:48:43.587964 | -3520.51 | -19.07 | 252000 | -0.00 | 4122136.18 | 283976.554436 | 288549.53 | 3275210.09 |

360 rows × 10 columns

This one is a but more simple, only examining the total rent you’ve paid in a given month and simulated stock returns at that point.

# Rental Table

df_rent = pd.DataFrame()

df_rent["Period"] = pd.Series(range(12*30)) + 1

df_rent["Date"] = pd.date_range(start=datetime.today(),

periods=12*30,

freq='MS',

name="Date")

df_rent["DownPayment_Invested"] = stock_performance * down_payment

df_rent["Rent_Paid"] = rent * 1.02**(df_rent["Period"].add(1) % 12 == 0).cumsum()

monthly_savings = df_own[["Principal_Paid", "Interest_Paid"]].sum(axis=1).multiply(-1).add(hoa) - df_rent["Rent_Paid"]

df_rent["Total_Rent_Paid"] = df_rent["Rent_Paid"].cumsum()

df_rent["Rent_Profit"] = df_rent["DownPayment_Invested"] - df_rent["Total_Rent_Paid"] + monthly_savings.cumsum()

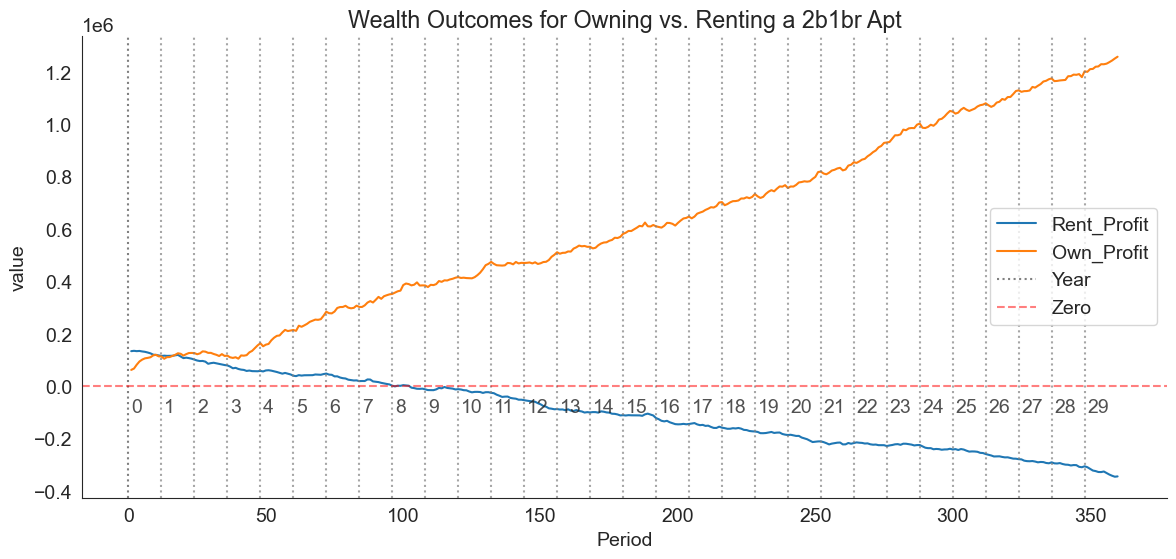

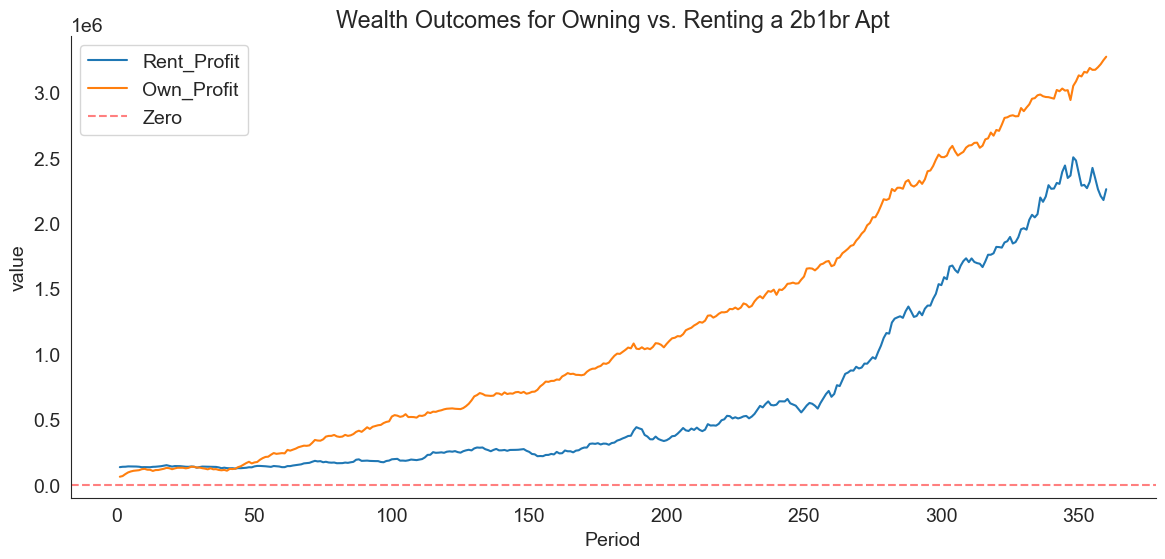

df_rent = round(df_rent, 2)At this point, I’ll merge the ownership and rental tables and plot out what happened in this simulation

plt.figure(figsize=(14, 6))

plt.title("Wealth Outcomes for Owning vs. Renting a 2b1br Apt")

sns.lineplot(data=merged, x="Period", y="value", hue="variable")

# for x in range(0, 350, 12):

# if x == 0:

# plt.axvline(x, color="grey", linestyle=":", alpha=1, label="Year")

# else:

# plt.axvline(x, color="grey", linestyle=":", alpha=0.7)

# plt.text(x+1, -100000, str(int(x/12)), alpha=0.8)

plt.axhline(0, color="red", linestyle="--", alpha=0.5, label="Zero")

plt.legend()

sns.despine()

We can quickly see that ownership will clearly build more wealth in the medium and long run:

years = 5

print(f"Owner after {years} years:", df_own.loc[12*years-1, "Own_Profit"])

print(f"Renter after {years} years:", df_rent.loc[12*years-1, "Rent_Profit"])Owner after 5 years: 243148.71

Renter after 5 years: 135926.53However, we can see that, in the unlikely case that the home is sold within the first year or so, the wealth of the renter and the owner are very similar, likely due to the owner contending with buying/selling fees:

years = 1

print(f"Owner after {years} years:", df_own.loc[12*years-1, "Own_Profit"])

print(f"Renter after {years} years:", df_rent.loc[12*years-1, "Rent_Profit"])Owner after 1 years: 115891.0

Renter after 1 years: 135331.15A possible takeaway here is that, as long as you can be confident you’ll be able to hold onto the house for more than a year, it’s probably better to purchase it. Uncertainty estimates would be useful here, and could be obtained by running the simulation under a wide variety of randomly generated market conditions.

@online{amerkhanian2022,

author = {Amerkhanian, Peter},

title = {Buy Vs. {Rent,} {A} {Financial} {Modeling} {Workflow} in

{Python}},

date = {2022-08-06},

url = {https://peter-amerkhanian.com/posts/rent-vs-buy/},

langid = {en}

}